The Inside Bar candlestick pattern is a popular and widely used trading strategy in the world of technical analysis. Traders and investors often leverage this pattern to make informed decisions about potential price movements in financial markets. In this article, we’ll explore the basics of the Inside Bar pattern, how to identify it on price charts, and strategies for incorporating it into your trading approach.

Understanding the Inside Bar Pattern

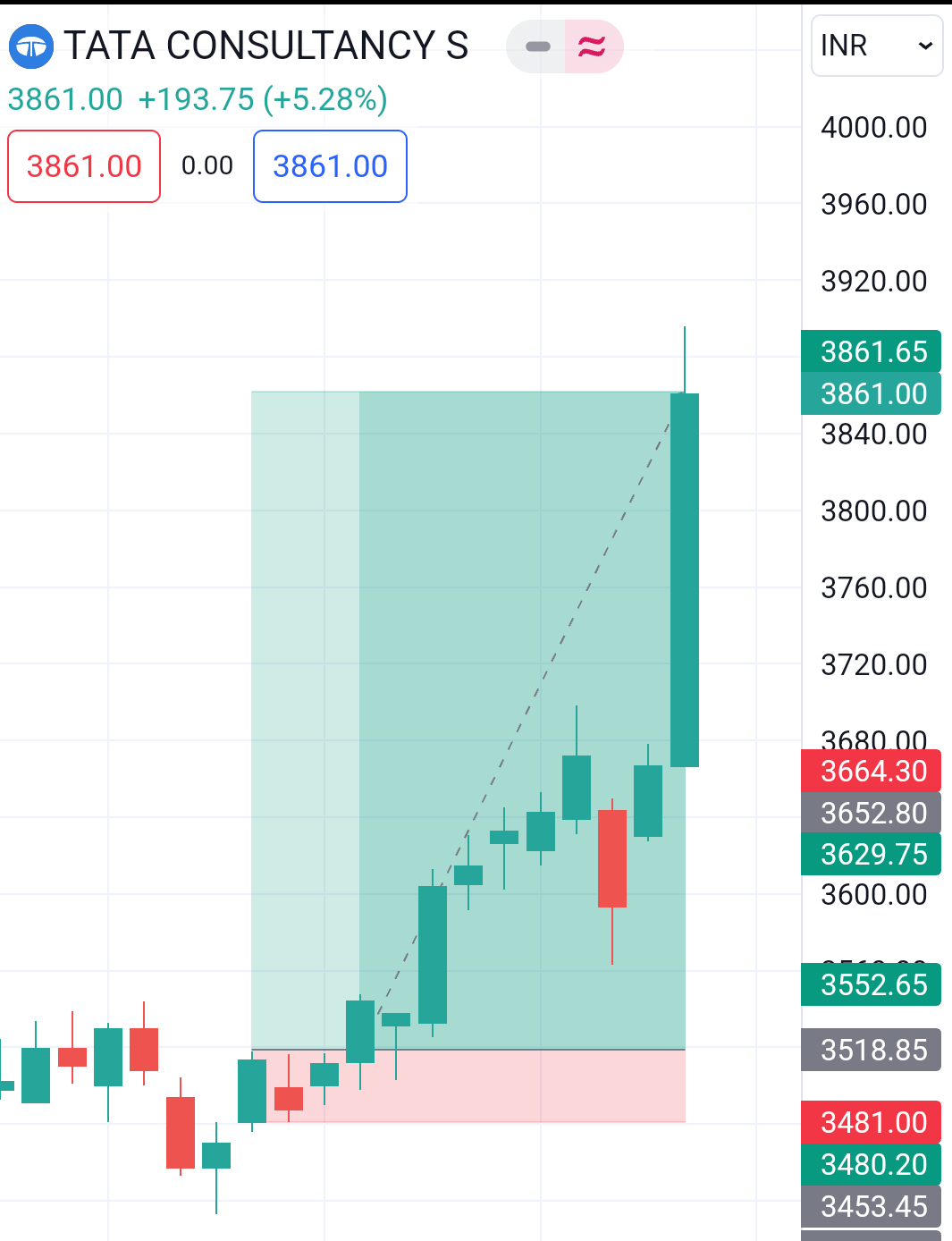

The Inside Bar pattern is a two-candlestick formation that signals a potential reversal or continuation in the prevailing trend. It consists of an “inside” candle, which is completely contained within the high-to-low range of the previous candle, known as the “mother bar.” The inside candle represents a period of consolidation or indecision in the market.

1. Components of the Inside Bar Pattern:

Mother Bar: The first candle in the pattern, which has a higher high and a lower low compared to the second candle.

Inside Bar:The second candle, completely contained within the high and low of the mother bar.

2. Types of Inside Bars:

Bullish Inside Bar: The inside bar appears after a downtrend, suggesting potential bullish reversal.

Bearish Inside Bar:The inside bar forms after an uptrend, indicating potential bearish reversal.

Identifying Inside Bars on Price Charts

Accurately identifying Inside Bars is crucial for implementing this strategy effectively. Here’s a step-by-step guide on how to spot them on price charts:

1. Visual Inspection:

– Begin by visually inspecting the price chart for consecutive candlesticks.

– Look for a candle whose entire range is within the high and low of the preceding candle.

2. Check Trend Context:

– Determine the prevailing trend in the market.

– For a bullish reversal, the Inside Bar should appear after a downtrend, and for a bearish reversal, it should follow an uptrend.

3. Confirmation:

– Confirm the Inside Bar pattern by waiting for the next candle to start trading beyond the high or low of the inside bar.

Inside Bar Trading Strategies

Now that we understand the basics of the Inside Bar pattern, let’s delve into different strategies traders employ to make informed decisions.

1. Breakout Strategy:

Entry: Enter a trade when the price breaks out above the high (for bullish setups) or below the low (for bearish setups) of the Inside Bar.

Stop-Loss: Place a stop-loss order just below the low (for bullish setups) or above the high (for bearish setups) of the Inside Bar.

2.Trend Continuation:

Entry: If the Inside Bar aligns with the prevailing trend, consider entering in the direction of the trend.

Confirmation: Confirm the trend continuation by observing subsequent price action.

3. Multiple Inside Bars:

Entry: Identify a series of Inside Bars, forming a pattern known as an “Inside Bar breakout.”

Confirmation: Enter the trade when the price breaks out of the range formed by the consecutive Inside Bars.

4. Combination with Other Indicators:

Entry: Combine the Inside Bar strategy with other technical indicators like moving averages or trendlines for added confirmation.

Confirmation:Wait for signals from multiple indicators to align before entering a trade.

Considerations and Risks

While the Inside Bar strategy can be a powerful tool in a trader’s arsenal, it’s essential to consider certain factors and risks:

1. Market Conditions:

– Assess the broader market conditions and economic factors before relying solely on the Inside Bar pattern.

2. False Signals:

– Like any trading strategy, the Inside Bar is not foolproof. False signals may occur, emphasizing the importance of risk management.

3. Timeframes:

– The effectiveness of the Inside Bar strategy may vary across different timeframes. It’s crucial to adapt the strategy to the specific timeframe you are trading.

4. Risk-Reward Ratio:

– Calculate and maintain a favorable risk-reward ratio to ensure that potential profits outweigh potential losses.

Conclusion

In conclusion, the Inside Bar candlestick pattern is a versatile tool for traders seeking to identify potential reversals or continuations in market trends. By understanding the components of the pattern, accurately spotting it on price charts, and implementing various trading strategies, traders can make informed decisions and improve the overall effectiveness of their trading approach. However, it’s crucial to remember that no strategy guarantees success, and risk management should always be a top priority for any trader. As with any trading strategy, practice, experience, and continuous learning are key to mastering the art of trading with Inside Bars. If you trade in the Indian stock market, and want to know which stocks have formed inside bars recently Click here

To learn about golden crossover strategy click Click here

Wow, superb weblog layout! How lengthy have you been running a blog for? you make blogging look easy. The entire look of your web site is magnificent, as well as the content material!

Almost all of what you point out is astonishingly accurate and it makes me wonder why I hadn’t looked at this in this light previously. This particular article really did switch the light on for me as far as this topic goes. However at this time there is one issue I am not necessarily too comfortable with so while I try to reconcile that with the main theme of the issue, allow me observe just what the rest of your visitors have to say.Nicely done.

Your house is valueble for me. Thanks!?